What’s your plan B

Adapting to Market Cycles: Alternative Asset Strategies for Real Estate Developers

The real estate sector is characterized by cyclical market fluctuations, which push developers to rethink and adjust their sales and operational strategies. In response to slower apartment sales, many developers are now exploring alternative asset management models.

While some of these ideas are still experimental and their long-term success is uncertain, they represent interesting attempts to integrate services and tools that generate added value. It’s also an opportunity to test new approaches—ones that treat housing not just as a product but increasingly as a service, in line with broader trends seen across many industries.

In some cases, these solutions become more than just innovative ideas—they’re financial lifelines, helping to preserve cash flow or optimize return on investment. But do they have the potential to become market standards? Can they effectively complement or even enhance traditional sales models? Let’s take a closer look at five selected strategies, along with their strengths and weaknesses.

Long-Term Rental with Property Management: Buy from Us, We’ll Manage It for You

Long-term residential rentals offer one of the most stable sources of passive income. Buyers can purchase a fully finished unit directly from a developer and place it in a managed rental pool, receiving steady income without needing to be involved in the day-to-day operations.

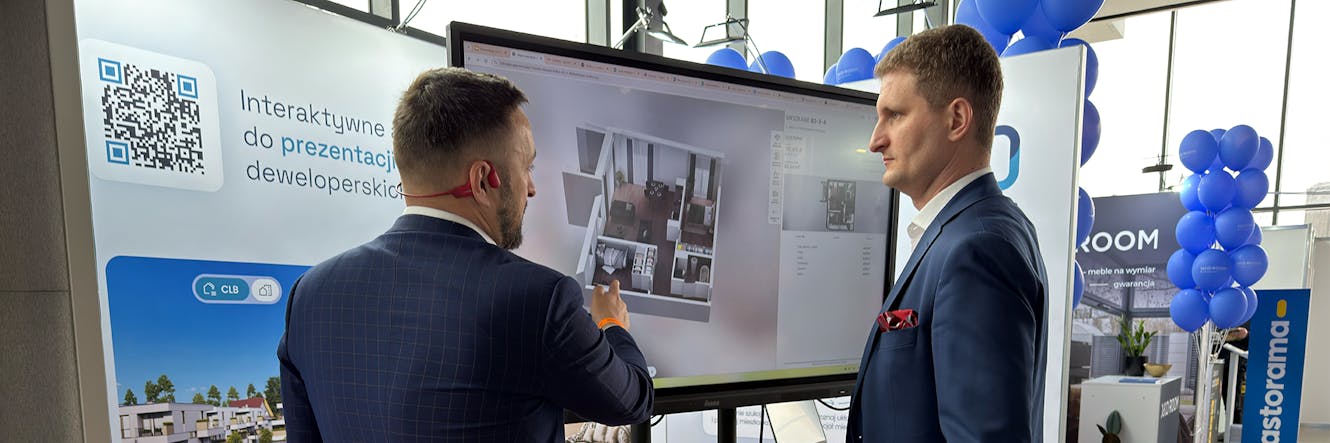

This model requires developers to provide full-service property management—including digital tools, billing systems, and ongoing maintenance. It is mostly adopted by larger companies with dedicated property management departments and the scale to support such services. It works particularly well in cities with strong rental demand, such as Poznań or Wrocław.

Customer Property Resale Program: Buy from Us, We’ll Help Sell Your Current Home

Developers are revisiting a familiar concept: assisting clients with the sale of their existing property. If the location and valuation are feasible (e.g., both units are in the same city), developers may offer to coordinate the process.

This is particularly appealing for buyers unfamiliar with legal procedures or reluctant to involve third-party agencies. With the support of the developer’s marketing infrastructure, the transaction becomes easier and more efficient for the customer.

Rent-to-Own: Try Before You Buy

This is one of the most complex but also most sought-after models. Rent-to-own allows tenants to gradually acquire ownership of a property by allocating part of the rent toward the purchase price.

It’s an attractive option for individuals who currently lack mortgage eligibility but plan to buy in the future. For developers, however, it ties up capital for extended periods. The sale is essentially on hold, and the only short-term return comes from rental income or installment payments.

nstitutional Leasing: Selling to Investment Funds

Institutional leasing is gaining momentum as developers partner with investment funds active in the Private Rental Sector (PRS). In this model, entire buildings or apartment portfolios are sold to institutional buyers, ensuring capital liquidity and reducing operational risk.

However, the trade-off is often a lower per-unit margin, more advanced turnkey requirements, and challenges in securing financing. Smaller developers lacking PRS experience may struggle to structure such deals from both legal and financial perspectives.

Short-Term Rental: Stay with Us, You Might Want to Buy

Short-term rentals via platforms like Airbnb or Booking.com can generate higher yields than long-term leases, especially in tourist or business-friendly locations. This model requires professional property management, often outsourced to specialized service providers.

Beyond profitability, it also doubles as a marketing strategy: “Stay for a few days—then buy the apartment.” Guests get a firsthand experience of the location and interior, and if they choose to buy, they can leave the unit in the short-term rental program as a managed investment.

Summary

These emerging models reflect a growing need for flexibility and creativity in today’s real estate market. They are not silver bullets—but in the hands of strategic developers, they can provide real competitive advantage, increase client trust, and diversify revenue streams.